Global Egg Industry Outlook: Growth, Transformation, and Opportunity Through 2035

14 October 2025

The global egg industry is entering a transformative period that will reshape how eggs are produced, traded, and consumed over the next decade. According to the new Global Egg Industry Outlook 2035 report by Rabobank’s Nan-Dirk Mulder, jointly developed with the World Egg Organisation, the market is set for robust growth, driven largely by emerging economies, shifting consumer preferences, and the rising importance of sustainability and digitalisation.

A changing global market

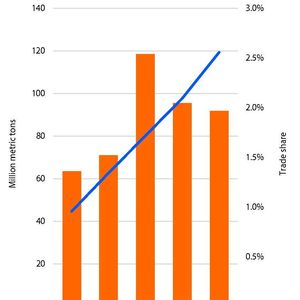

The global egg market is projected to expand by 2% annually in volume, resulting in a 22% larger market by 2035. Yet growth will not be evenly distributed. Nearly 90% of new demand will come from emerging markets, particularly in Asia, Africa, and Latin America. Rising incomes, urbanisation, and improving availability will be key drivers, fuelling higher per capita consumption in regions where egg intake currently lags.

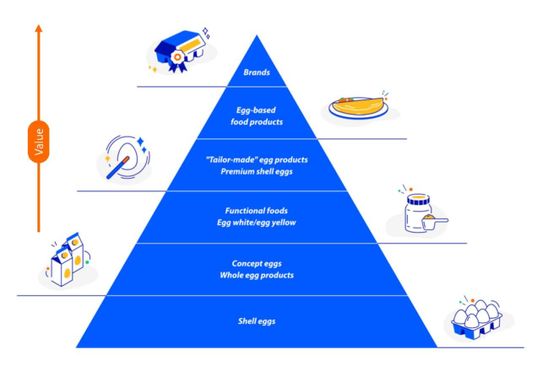

Meanwhile, growth in high-income markets is slowing, but consumer expectations are rising. In these regions, the spotlight is shifting to value-added products such as organic, cage-free, and functional eggs enriched with nutrients like omega-3s. Health, sustainability, taste, and animal welfare are increasingly influential in purchasing decisions, particularly among younger consumers.

Retail is reshaping the egg industry

Traditional grocery retail has long dominated egg sales worldwide, but the channels are evolving rapidly. In emerging markets, distribution is shifting from open-air and wet markets toward modern grocery and online food delivery. In regions like Southeast Asia, China, and India, digital platforms are transforming how consumers access eggs and egg-based products.

Food service channels are developing in emerging economies, where dining out is already popular, enabling eggs to find a new relevance in breakfast solutions and ready-to-eat products.

For producers, grocery retail will remain a key sales outlet – especially as it accelerates in emerging economies – but staying competitive requires strategic investment in marketing and product development, as both shell eggs and egg products are set to capture a larger share of consumer spending.

Modernisation of the supply chain

Globalisation is giving way to localisation in egg production supply chains. With only 2% of eggs currently traded internationally, most investment in supply chains is aimed at creating local-for-local production systems. This shift prioritises efficiency, biosecurity, and value in the face of avian influenza outbreaks and geopolitical tensions.

The industry is also undergoing a structural transformation. Vertical integration is increasing, cage-free systems are expanding beyond Western markets, and smart farming technologies are becoming standard. Digital tools and artificial intelligence are expected to play a central role in boosting productivity, ensuring traceability across the supply chain, and are essential for producer competitiveness.

Investment and innovation opportunities

Looking ahead, the egg sector will require significant capital investment. Greenfield expansion, cage-free transitions, and the development of value-added products will drive spending. Strategic focus will be on modernisation, sustainability, and digitalisation, with technologies such as genomics, robotics, and artificial intelligence leading the way.

For industry leaders, investors, and policymakers, the opportunities are wide-ranging, although not without risk, and this report provides essential insights into what lies ahead through 2035.